Turn your business receivables into working capital.

Do you have a great growing business, but with cash flow that isn’t as consistent as it needs to be? Turn your receivables into working capital.

No matter how well your business is operating, invoicing and payments are inconsistent and unpredictable.

Watch the video to learn more about Renasant Bank's BusinessManager™.

Turn your business receivables into working capital.

Do you have a great growing business, but with cash flow that isn’t as consistent as it needs to be? Turn your receivables into working capital.

No matter how well your business is operating, invoicing and payments are inconsistent and unpredictable.

Watch the video to learn more about Renasant Bank's BusinessManager™.

Interested in talking to our BusinessManager™ team?

Email us at [email protected], or call us at 833-353-9744.

*Email is not a secure method of communication and should not be used to provide personal information, such as account numbers, social security numbers, pin numbers, dates of birth, etc.

Renasant Bank's BusinessManager™ is the solution to get the cash you need to operate your growing business. Renasant Bank will purchase your business’s accounts receivable and then make consistent daily deposits into your account based on your long-term income. Now you have the cash flow you need without waiting on invoices to be paid.

- Get the working capital you need through consistent cash flow

- Have quick access to cash when you need it

- Stop waiting 30, 60 or 90 days for payment on products sold or services rendered

- Provides more flexible options than traditional financing

- Don’t wait to purchase new equipment or upgrade technology to improve customer experience

- Take advantage of supplier discounts for upfront or prompt payments

Find out how accounts receivable financing works

Inconsistent business and unpaid invoices can be the most challenging aspects of running a growing business, and waiting for invoices to be paid is as predictable as the weather. By financing your accounts receivable through Renasant Bank’s BusinessManager™, you don’t have to worry about cash flow any more.

- Renasant Bank purchases your accounts receivable at a negotiated rate, both initially and on an ongoing basis, as new receivables are generated.

- Funds are consistently deposited into your account based on the long-term value of your accounts receivables.

- Using a solution customized to your business, Renasant Bank collects your accounts receivables without your customers ever experiencing a change.

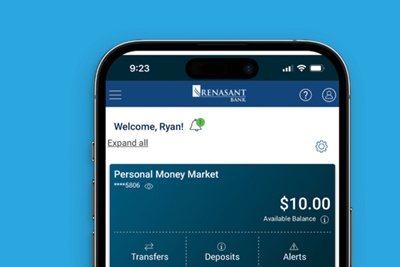

- Using BusinessManager’s secure, online commerce feature, you can exchange receivables information quickly and easily with Renasant Bank.

- You also gain access to detailed management reports with important information on aged receivables, customer balances, credit applications and more.

BusinessManager™ is the perfect solution for fast growing businesses. Renasant Bank’s staff has the knowledge and experience to help ease growing pains. Let Renasant Bank’s BusinessManager™ team talk to you about using accounts receivable financing to grow your business.

Terms and Conditions

*All loans are subject to credit approval.

The coaching carousel is in full effect which means 4 SEC teams are currently shopping for coaches. So what do you do when you need to replace the head ball coach? Head on over to the coach shop and sample the wears.

Renasant strives for simplicity and efficiency — especially when it comes to the busy lives of our customers. That’s why we’ve installed ATMs with Live Banker throughout various markets and are adding more.

For more than 40 years, baseball broadcasters Jim Ellis, John Cox, and David Kellum have had the privilege of calling college baseball on the radio. These legendary announcers share memories of their time and how they made it to the broadcaster's booth.

Check out some simple ways on how to teach your children to make financial decisions. Prevent them from making the same mistakes you did as well as keeping their eyes and wallets the same size.

The Doggie Camel Pack is a revolutionized way to help dogs lighten the load of a hike by carrying their own gear. It is a self-serving hydration pack set to keep a man's best friend happy and healthy.

Check out a few of our tips on buying a home. From mortgage options to house hunting seasons and homeownership responsibility, Renasant has you covered.

Only have one type of account? Checking handles your day-to-day transactions while savings holds your money for a longer period. Read here to learn more about checking and savings accounts.